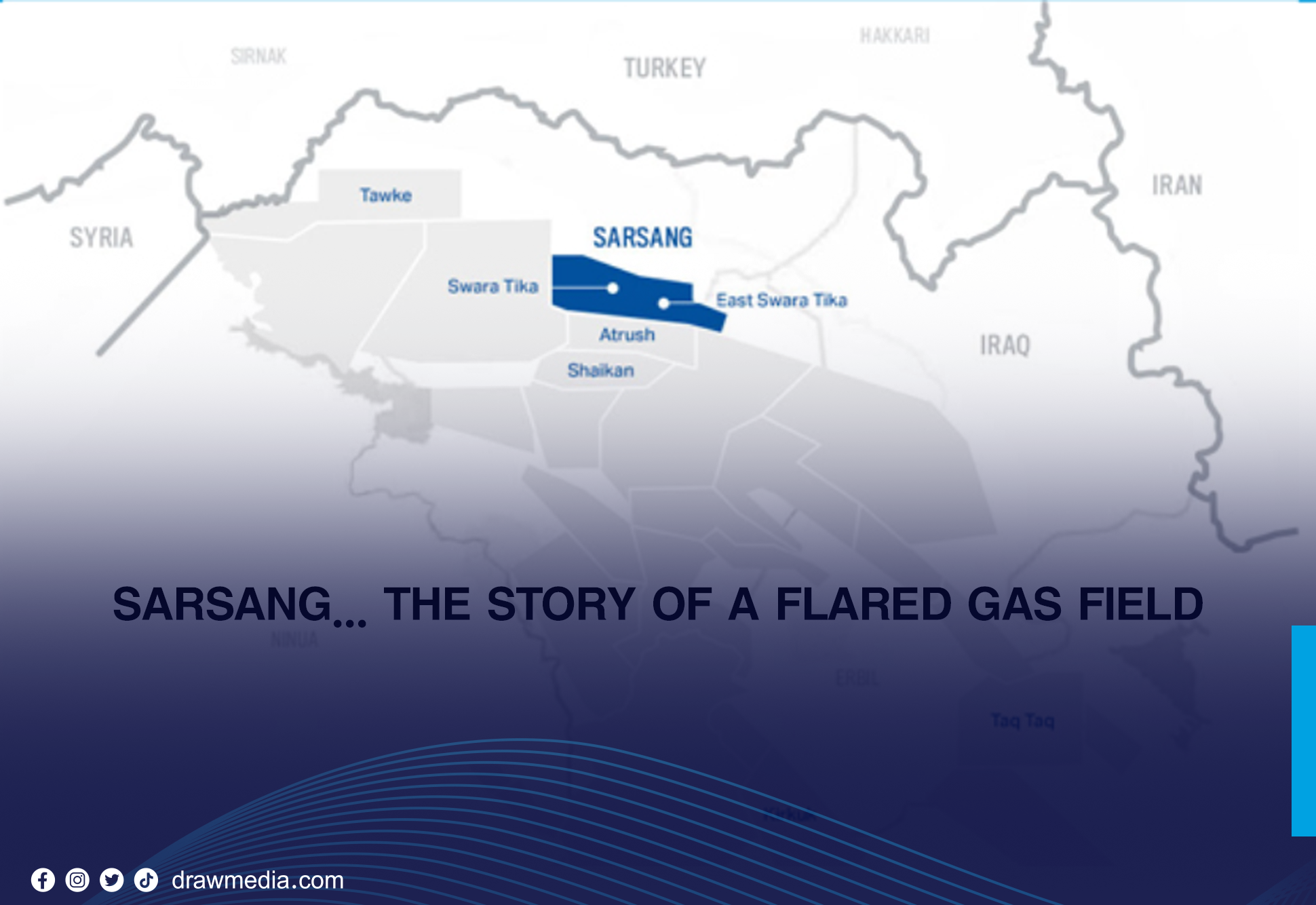

Sarsang... The Story of a Flared Gas Field

2025-07-15 13:10:14

The Sarsang oil field, located in the Duhok Governorate, spans an area of 420 square kilometers and is divided into two separate oil zones: Swara Tuka and East Swara Tuka. Each contains three independent oil reservoirs. Estimates suggest the field holds 2 billion barrels of recoverable oil.

The oil here is light and sweet, with a high API gravity and low sulfur content, making it compatible with Brent crude and requiring minimal refining. The operating expenditure (OPEX) for production is low, approximately $5.6 per barrel.

On November 6, 2007, the Iraqi Ministry of Natural Resources awarded an exploration and production sharing contract (EPSC) to the American company HKN. Exploration began in 2008, and oil was discovered in 2011.

According to a February 2014 report from the Ministry of Natural Resources, 213 workers were employed at the site by HKN at that time, with 173 of them being local, representing 81% local workforce participation.

The field also contains natural gas, which has mostly been flared. In March 2022, Kamal Mohammed, then Minister of Electricity and acting Minister of Natural Resources, met with two foreign companies and requested studies on how to utilize the flared gas for power generation. This would both help solve electricity supply issues and protect the environment.

Ownership shares in the Sarsang field currently stand as follows:

-

62% – HKN (U.S.)

-

18% – ShaMaran Petroleum (Canada), which purchased the French company Total's stake for $155 million in September 2022.

-

20% – Kurdistan Regional Government (KRG)

As of 2021, Total's share in the field was producing around 3,500 barrels per day.

Field Capacity and Production Zones:

1. Swara Tuka (Main Zone):

-

Contains 6 wells

-

Production capacity: 29,000 barrels/day

-

Oil quality: API 36–39

2. East Swara Tuka:

-

Contains 1 well

-

Production capacity: 2,500 barrels/day

-

Oil quality: API 36–39

In June 2022, after a Federal Supreme Court ruling that invalidated the KRG’s oil and gas law, Iraq’s Oil Ministry increased pressure on international oil companies in the region. The American service company Schlumberger, which had been working with HKN in the Sarsang field since 2012, withdrew from Kurdistan. It had drilled 7 wells at the site and held contracts to drill 5 more to increase daily production to 50,000 barrels by 2023.

Similarly, Baker Hughes, another U.S. oilfield services company, also withdrew during previous political tensions between Baghdad and Erbil.

In March 2023, just before KRG crude exports to Turkey halted (March 25, 2023), Sarsang’s daily output had reached 43,000 barrels/day. After the halt, production dropped to 33,600 barrels/day.

Recent Financials:

In Q1 of 2024, ShaMaran Petroleum announced:

-

Total revenue: $22.59 million

-

Daily average production: 37,200 barrels

-

Sales: 3.35 million barrels

This sales volume exceeded pre-export shutdown levels.

Historical Production Growth (2016–2024):

-

2016: 5,000 bpd

-

2017: 10,000 bpd

-

2018: 17,000 bpd

-

2019: 23,000 bpd

-

2020: 24,000 bpd

-

2021: 31,000 bpd

-

2022: 33,000 bpd

-

2023: 43,000 bpd (until exports halted in March) → then dropped to 33,600 bpd

-

2024: 37,000 bpd

Sources:

-

KRG Ministry of Natural Resources: https://archive.gov.krd/mnr/mnr.krg.org/index.php/en.html

-

ShaMaran Petroleum: https://shamaranpetroleum.com/

-

HKN Energy: https://www.hknenergy.com/

-

Total's withdrawal: https://drawmedia.net/page_detail?smart-id=11071

-

Iraq Business News: https://www.iraq-businessnews.com/2022/06/29/schlumberger-withdraws-from-iraqi-kurdistan/

-

ATTAQA energy news: https://attaqa.net/...

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)