Kurdish production complicates Baghdad’s gas ambitions

2024-09-03 14:07:31

Iraqi Kurdistan continues to increase its oil production despite restrictions from Baghdad, which is trying to comply with OPEC+ quotas and attract US gas investment to diversify its energy sources.

Oil production in Iraq’s Kurdistan region is increasing, despite efforts by the central government in Baghdad to limit it and meet OPEC+ quotas.

The latest data from SOMO (State Oil Marketing Organization) show Iraq producing 4.33 million barrels per day (b/d) in July 2024, exceeding the imposed quota of 3.93 million b/d by 400,000 b/d.

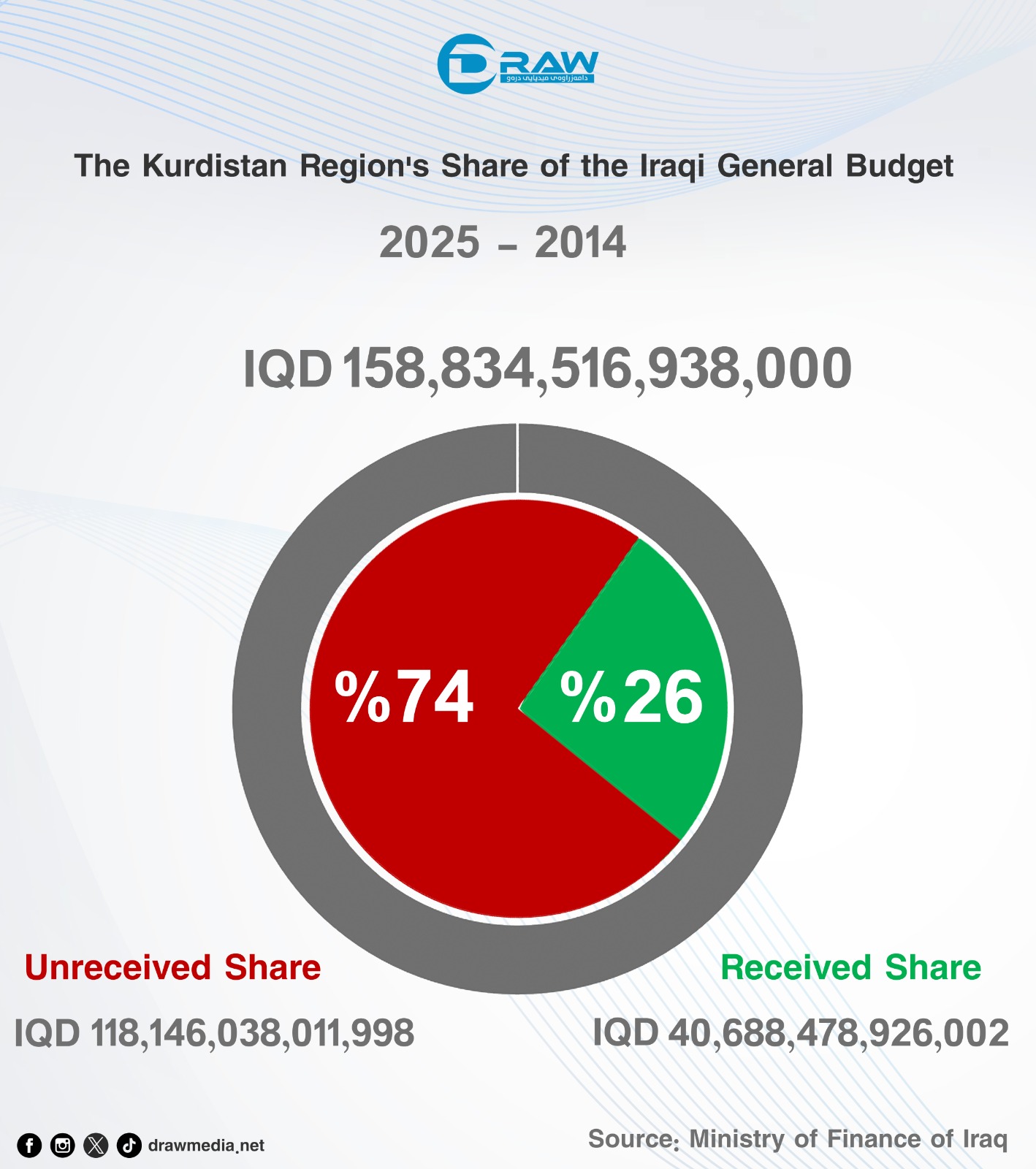

This situation is creating growing tensions between the federal government and the Kurdistan Regional Government (KRG), with threats of cuts to the federal budget allocated to the Kurdish region if production levels are not adjusted.

Baghdad seeks to attract US investment in the gas sector

To offset these tensions and improve its economic position, Iraq is banking on the development of its gas sector.

Oil Minister Hayan Abdel-Ghani has announced that he will present ten gas exploration blocks to American companies during a forthcoming visit to the United States.

This initiative comes after several licensing rounds in which the majority of available fields were awarded to Chinese companies, leaving blocks untapped.

The project aims to diversify Iraq’s energy partnerships and reduce dependence on gas imports, particularly from Iran, essential for supplying energy to power plants.

In addition, Iraq plans to launch a new gas project by the end of the year on the Al-Faihaa oil field in the south of the country, with an estimated production capacity of 125 million standard cubic feet (mscf).

This project is part of a wider strategy that also includes recent agreements to develop 13 oil and gas blocks, strengthening the local energy infrastructure.

Oil companies expand in Kurdistan despite restrictions

Meanwhile, oil companies operating in Kurdistan continue to expand their activities.

DNO, a Norwegian company, is mobilizing a new drilling rig at the Tawke site, increasing production to 79,800 b/d in the second quarter of 2024.

This expansion marks a significant recovery from previous slowdowns, although export constraints persist due to the closure of the pipeline to Turkey.

Other players such as Shamaran Petroleum and Gulf Keystone are adopting similar strategies, stepping up their trucking operations to move crude to the local market, compensating for the absence of regular exports.

Gulf Keystone reports an improvement in its financial situation and a return to positive cash flow for the first half of 2024, while adjusting its operations to market realities.

Implications for Iraq’s compliance with OPEC+ quotas

The surge in Kurdish oil production poses a direct challenge to Iraq’s efforts to meet its OPEC+ commitments.

SOMO disputes the production figures published by international companies in the Kurdistan region, believing them to be lower than announced.

This uncertainty makes it difficult to monitor total production and compliance with quotas, exacerbating tensions between Erbil and Baghdad.

In response to these difficulties, Baghdad stepped up the pressure on the KRG by reaffirming that any additional production above 46,000 b/d would have to be accompanied by payments to the federal government.

This measure is intended to deter any attempt by the KRG to increase production autonomously without coordination with the central government.

Domestic market and logistics challenges

Faced with the continuing closure of the pipeline to Ceyhan in Turkey, Kurdish producers are looking for alternatives on the domestic market.

Crude is sold locally at prices ranging from $28 to $40 a barrel, well below international tariffs.

Local refineries process crude oil into products such as diesel and gasoil, while some volumes are smuggled across the border into Iran and Syria.

Local authorities, meanwhile, are closing down illegal refining facilities and imposing environmental protection requirements on unlicensed refineries.

These actions demonstrate an attempt to regulate a local market that is increasingly diversified, but also difficult to control in a context of political and economic uncertainty.

Future strategies and geopolitical issues

The continued closure of the Kurdistan-Turkey pipeline and the uncertainties surrounding its reopening add to the complexity of Iraq’s energy situation.

A resumption of exports via this route could further complicate Iraq’s OPEC+ compliance efforts, creating a dilemma for Baghdad.

In this context, the approach of energy diversification and reducing import dependency by attracting US investment appears to be a pragmatic strategy for securing the country’s energy future.

Iraq’s energy challenges continue to evolve in an environment marked by internal rivalries and complex international dynamics.

Efforts to balance oil production, meet international commitments and attract new economic partners will define the country’s future trajectory on the global energy scene.

Source: energynews

.jpg)

.png)

.jpg)

.jpg)